How You Can Increase Your Profits by 10x At Zero Cost With YourKPO

Discover hidden profit and sales in your organization, and that too, at no cost or risk. Unbelievable? Then here is our promise – a 10X increase in profit or no fee*

Most businesses think that spending more money on marketing and sales, adding more sales resources, and implementing expensive IT systems holds the key to increasing profits and sales. It might be needed, but only after you have unlocked the full potential of your existing business infrastructure & systems.

How does YourKPO’s Unique Approach Help You Drive Profits & Sales?

Your KPO is a finance forward growth consulting firm focused on SMBs to help them drive profit and sales growth.

But Your KPO is unlike another accounting firm.

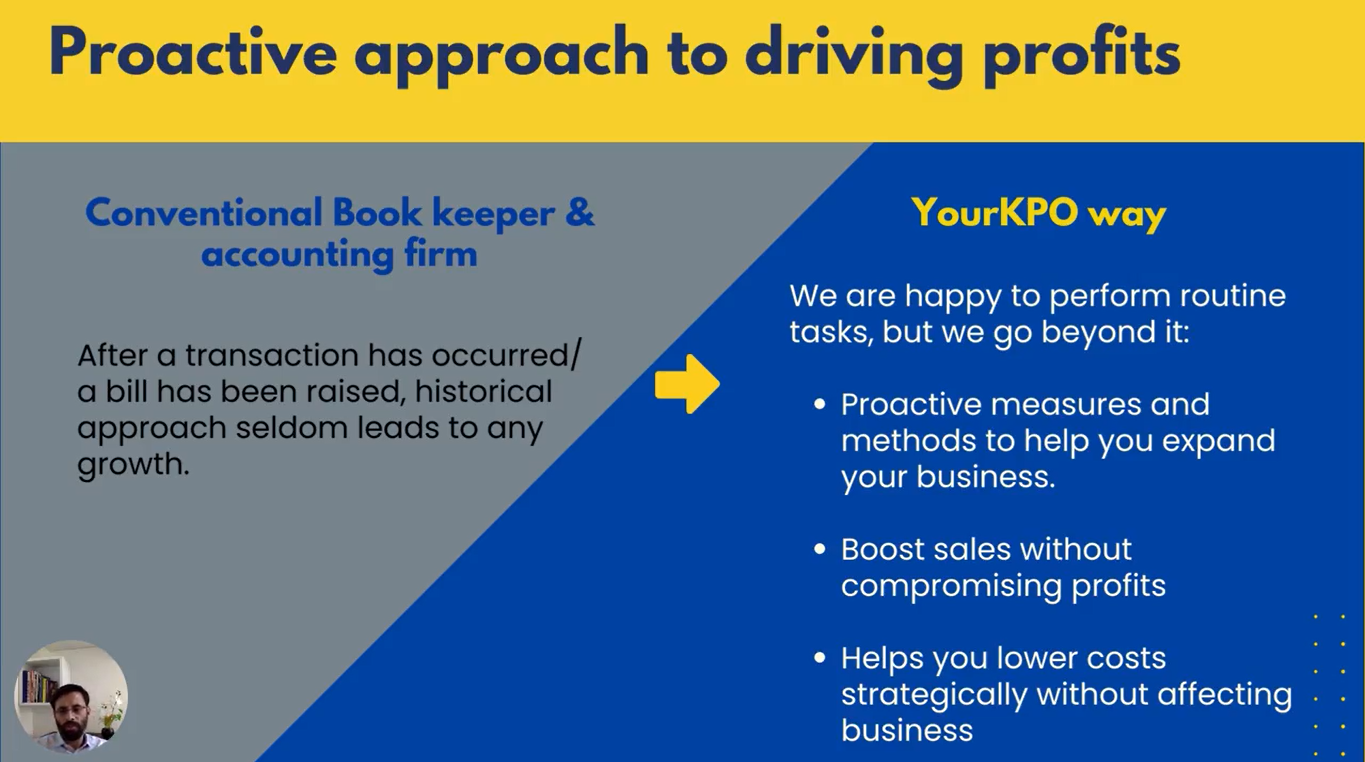

Core Function of Traditional Finance & Accounting Firms Vs YourKPO

The traditional bookkeeper’s role is more related to just helping your firm in preparing accounts and filing returns. Other sophisticated accounting firms might even help you evaluate the past data by using traditional parameters including contribution to past margin, net profits, and more. But the key function that almost every traditional bookkeeping and accounting firm is missing is helping your business increase profits.

That’s where YourKPO can be the game-changer for your business. How? YourKPO helps you to:

- Take proactive measures to expand your business.

- Boost your sales without compromising margins.

- Reduce cost without affecting operations.

How does YourKPO drive these results for you?

After years of research and experience, we have identified three key focus areas through which we are able to find hidden profits for you. Be it a manufacturing company or a plain startup, using these proven parameters we help you find hidden profits and maximize sales in the long run.

Three Focus Areas That We Help Clients With:

- Increase Operational Efficiency

- Financial rigor and business growth

- Business scaling without adding fixed overheads

Let’s uncover these parameters one by one:

1. Increase Operational Efficiency :

Being your CFO partner, the first focus area that we try to optimize for your business is to increase operational efficiency. Operational efficiency is the core relationship between your business’s outputs and inputs. Our experts take all the measures to identify the unnecessary costs incurred by your business, which directly relate to increasing your overall business revenues. We start with identifying all your baseline operations and try to find a room where we can reduce the costs.

So, how do we help you increase your operational efficiency? We do it in three measured steps, namely:

- Zero cost sales profit jumpstart

- Improve cash flow from existing operations, infrastructure, and assets

- Strategically cut costs without impacting business operations.

Each step is designed to take you closer to maximum efficiency in your operation. Firstly, we help you focus on the toolkit of over 73 parameters that most businesses do not care to include. This toolkit comprises upsells, cross-sells, reactivation of lapsed customers, the opportunity to have a joint venture, partnership, and many more. We also help you convert the one-time revenue into MMR (Monthly Recurring Revenue). Overall increases your profits as operational efficiency increases.

After identifying these parameters according to your business, we go to the second step, which is improving your cash flow. We approach this issue by helping you reduce A/R timelines by almost 40-50%, optimizing inventory, and negotiating better conditions with suppliers and consumers.

Our third and last step includes cutting costs without impacting other crucial business operations. We approach these issues by identifying the core areas of your business and outsourcing all the non-core functions for maximum efficiency. We also give major importance to the automation of repetitive tasks to reduce the workload on employees. This, at one end, increases operational efficiency and, on the other hand, multiplies profit numbers.

Apart from this, the following functionality in this focus area is refinancing the high-cost interests or capital loans. Doing this helps lower your monthly payments by 50-80%, consequently leading to a significant reduction in your operational costs. Further, we help you improve both your credit score and utilization ratio by refinancing.

2. Financial Rigour + Business Growth

This is another focus area in which we help you achieve financial rigour. Our core expertise falls in establishing a deeper understanding of strategy, integrating financial acumen to build leadership skills, and better communicating financial knowledge to your business. Our CFOs move beyond the number-crunching function to act and lead in this capacity by creatively assessing and designing growth opportunities for your business. This focus area is concerned to:

- Cost management

- Budgeting

- Access to funding

- Assessment of performance targets

- Identifying potential options for capital maximization

We execute this in three strategic steps namely

- Implementing systems and checking for profitable growth

- Bookkeeping and statutory compliance

- Virtual CFO offering

Each step fulfills a significant objective to achieve growth. In the first step, the YourKPO team focuses on developing a process that allows your company to grow without increasing costs. How do we accomplish this objective? Here’s how. We map your customer acquisition or growth engine. Then identify and install revenue amplifiers, followed by implementing checks to identify early warning signs to reduce customer churn rates.

After implementing the system, YourKPO now shifts focus to bookkeeping and statutory compliance. But we don’t just stop here; we also plan tax savings for you, which most companies fail to do successfully.

It’s no secret that compliance is a significant part of business and that you are not breaking any rules. Our focus remains on helping you save tax while ensuring that you are following the latest government policies.

Last but not least, do we implement virtual CFO services? What’ virtual CFO? In virtual CFO, we provide fractional service. The CFO represents your company to bankers and investors, helps you structure business deals, makes business and EBITDA plans, reduces OPEX, etc.

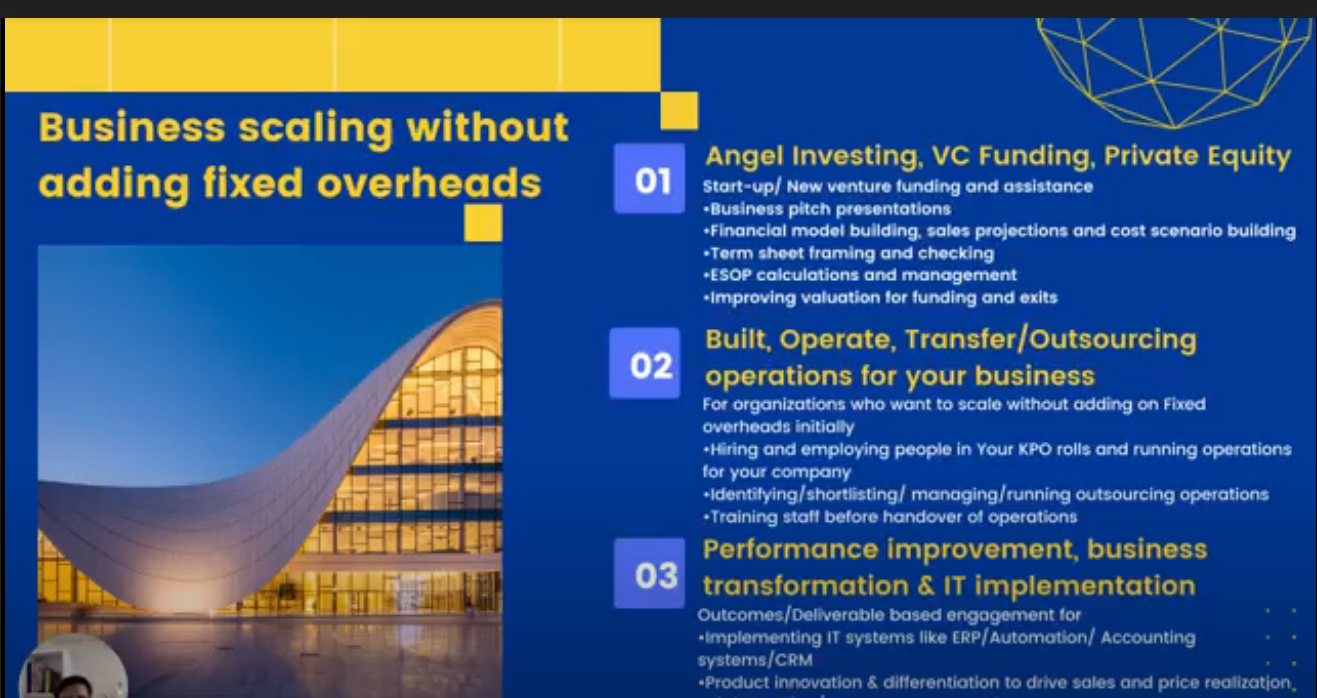

3. Business Scaling Without Adding Fixed Overhead

Last but not in, our focus area is Business Scaling Without Adding Overhead.

As it’s rightly said that “a failure to grow can be catastrophic.”

Generally, most startups and businesses think of growth in linear terms by adding new resources, which requires additional CAPEX and OPEX. But, we have identified and executed strategies to help you scale up your business without a substantial increase in resources.

It may seem like a distant reality to many businesses to scale the business without adding overhead, but YourKPO can help you with it. Our system has helped us grow our client’s businesses without adding extra costs.

We do so in three parameters, namely:

- Angel Investing, VC funding, Private Equity.

- Build, operate, and transfer operations for your business

- Performance improvement, business transformation, and IT implementation.

So let’s dive in. In Angel Investing, we help you present your pitch, build financial models, improving value for exits and funding.

After this, our second parameter is building, operating, and transferring your business operations. This is suitable for organizations who want to scale without adding Fixed Overhead costs. In this, YourKPO handles all the primary operations, including hiring employees on YourKPO roll and running business operations on the company’s behalf. We also train all the staff before handing over operations to the client company. Not only does this reduce fixed costs for the company, but it also saves it from efforts of hiring and managing operations.

Next in the process is the improvement of performance, business transformation, and IT implementation. This is the last leg of the journey, where your company has already established a strong foundation/. Now it’s time to improve the performance of the existing operations and bring in transformation. We help you achieve this by implementing ERP, accounting, and CRM systems and innovating products and services to drive sales and management of the IT infrastructure of the company.

Your KPO – team of cross-functional experts from Finance, sales, Marketing, Operations, etc.

Your KPO’s skin-in-the-game ‘Profit First’ philosophy

We work differently by showing clients the potential seepage and revenue opportunities, get alignment, and only then do we proceed to the next step.

The majority of businesses believe that to increase profits and sales, they must be spending on marketing and sales tactics, more resources, and implementing a top IT system. But they are dead wrong!

Yes, all these features are important, but they do not necessarily convert to more profits and sales. In fact, sometimes, they may act as the biggest overhead costs for your business, eating away at your profits.

In the worst-case scenario, businesses will be unable to find the reason behind their stunted growth. That’s where YourKPO helps. It’s our mission to help you not leave any of your money on the table and maximize profits from the get-go. We do all this by implementing a tested system that we have explained in detail above.

So, are you ready to unlock your full business potential? If yes, then you are just one step away. Consult YourKPO and watch those sales numbers grow!

Reach out for a free 45 mins diagnosis that can unlock profit and sales in your business.

Done with you, Done for you – A 90-Day Sprint Cycle

Leave A Comment